According to the FFIEC manual, you should reassess your FI’s current BSA/AML risks every 12 to 18 months. While it is not necessary for this to be done outside of the bank; it is valuable to periodically get an independent perspective. This outsider’s view can be refreshing and helps to further demonstrate your willingness to ensure your FI is compliant. With the push to innovate our AML programs, we have seen risk assessments evolve over the last 15 years moving away from a qualitative approach toward a detailed, quantitative methodology.

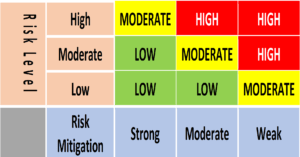

Our risk assessment methodology has been proven advantageous and withstood regulator review year over year. We take a scientific approach to quantitatively demonstrate all of your risk factors, your risk mitigation effectiveness, and the overall risk to your institution. We will statistically prove what your risk actually is versus what you believe by analyzing your bank’s data.

ARC’s Recommendations for an Effective Risk Assessment

Key Benefits of our Service:

- A thorough review of your institution’s risk, including your inherent risks, your risk mitigation, and your residual risk.

- A legal and regulatory perspective on your institutions risk, through the eyes of our AML specialized experienced professionals.

- An independent risk assessment, that has undergone our rigorous quality control process.