PREMIER SERVICE

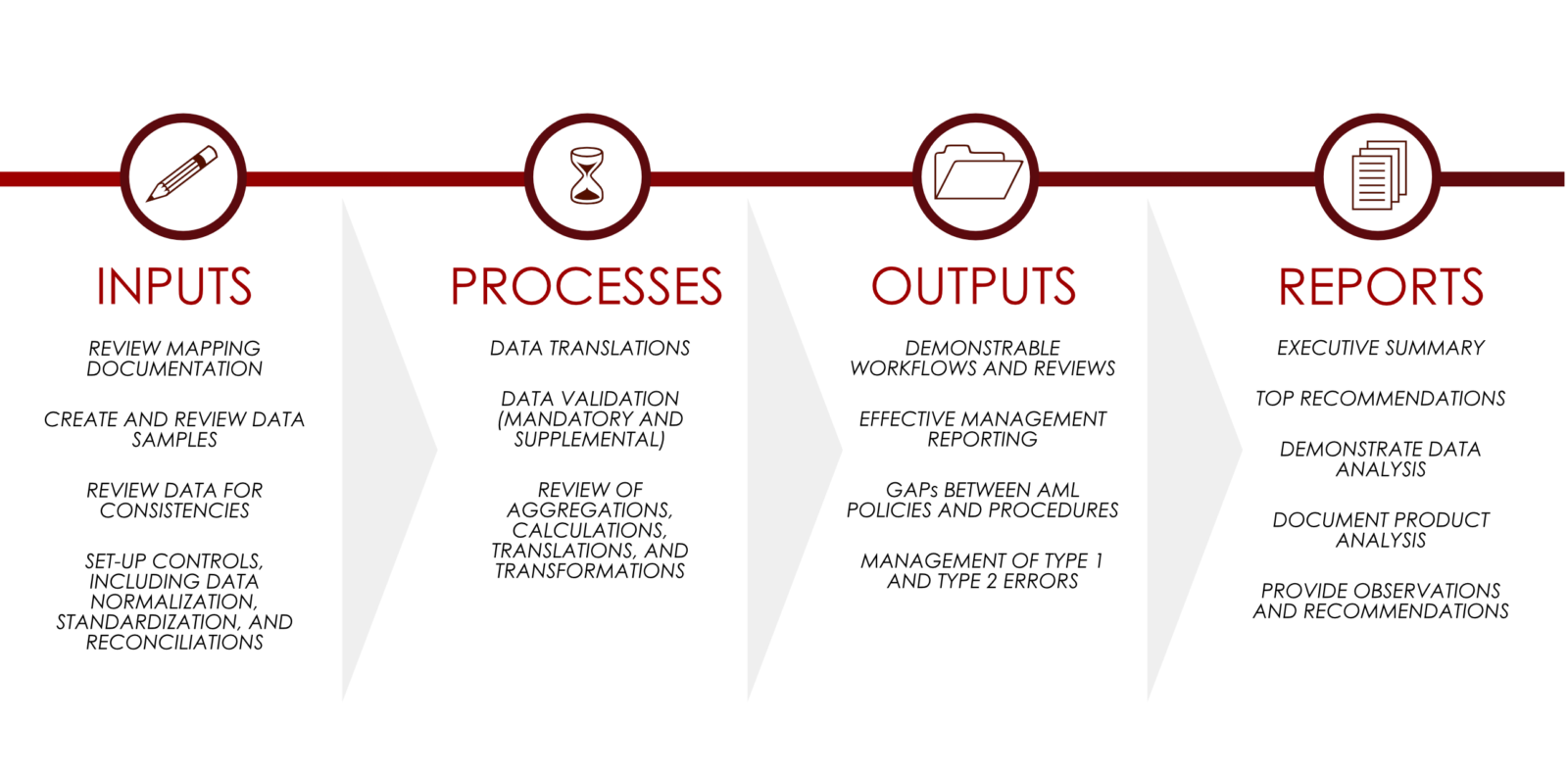

According to the guidance provided by the Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC), National Credit Union Administration (NCUA), and The Federal Reserve System on model risk management, “the use of models invariably presents risk” and the risk presents itself typically in two aspects: there may be fundamental errors or it’s being used incorrectly. It is for this reason, how a model validation is conducted is what matters the most. Valuable model validations are independent, completed by experts who understand the use of a model, and review all related parts of the model. More specifically, an anti-money laundering model is not the same as a credit risk model.

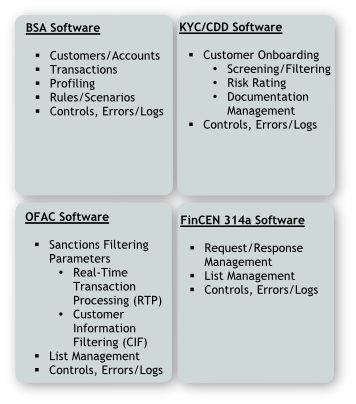

An AML model validation includes a thorough review of three parts: Governance, System, and Data. Each part on their own is not effective in demonstrating that the model is working; in order to meet the required depth of an AML Model Validation, you must look at all three parts. As an AML industry leader, our model validation has always been and continues to meet the requirements of even the most stringent regulations, such as New York

State’s Department of Financial Services Part 504, and has passed through many successful examinations at our clients.

Systems We Have Worked With:

- Actimize

- AmLock

- Abrigo (BAM+)

- Bridger

- EastNets

- eGifts

- FCRM

- Ficrosoft/Acquity

- FiServ FCRM

- Global Vision

- Norkom/Detica

- Mantis

- Ocean Systems

- Prime Compliance Suite

- Proprietary/Custom System

- SAS

- Surety

- Verafin

- Wolters Kluwer

- Yellow Hammer