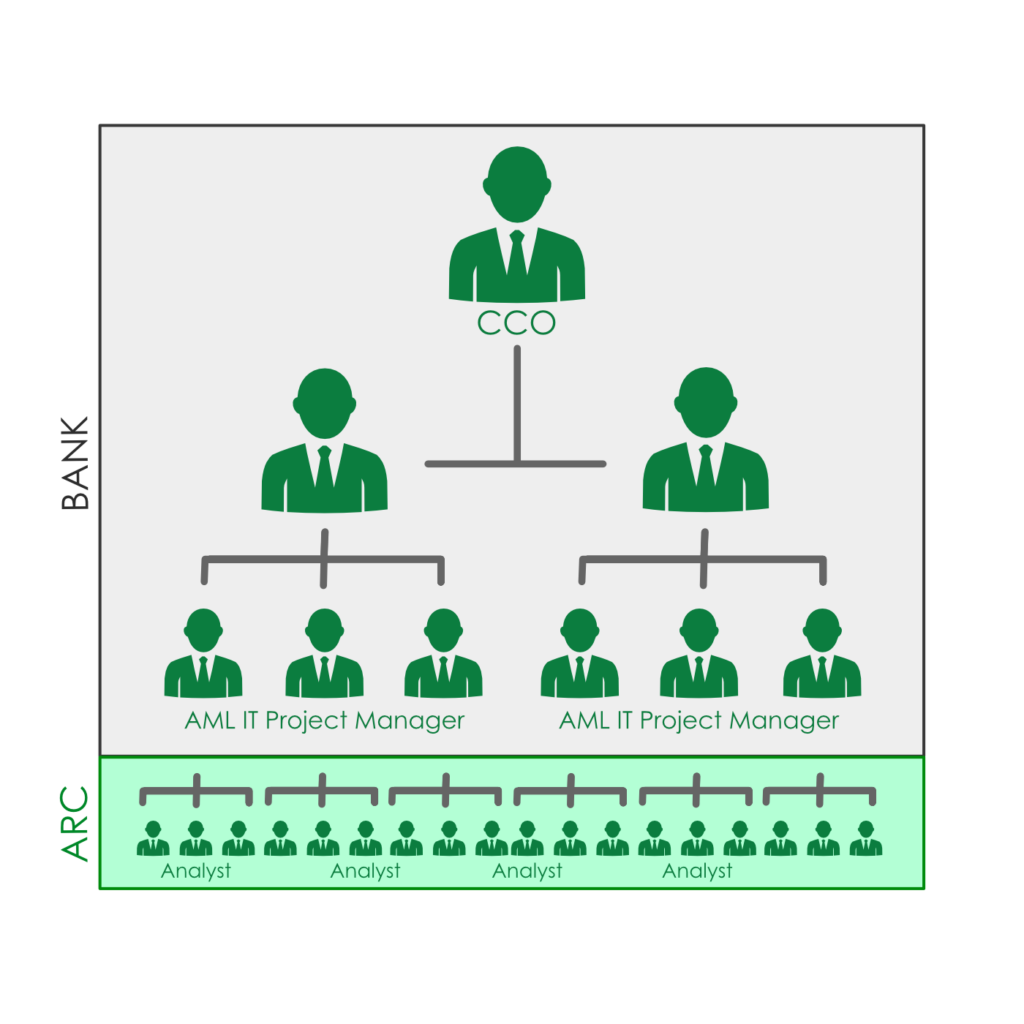

Financial institutions and credit unions are tasked with monitoring financial transactions, screening their transactions and customers/members for sanction restrictions, and really knowing who their customer is. These tasks come with regulatory burdens, financial burdens, and administrative burdens. As a means to minimize this burden on the U.S. financial system, FinCEN released an interagency statement encouraging financial institutions to consider ways of sharing BSA-necessary resources.

What happens when you don’t have the staff to manage your BSA program in-house? We can help you with that. We will work with you to understand and maintain the standards of your policies and procedures and engage a new appropriate software vendor. Our team would be completely off-site so we don’t take up additional desk space at your office, and 100% of case review would be done completely by our team, saving you time. Further, we would demand the highest requirements for quality assurance from our staff and accomplish this by assigning an experienced lead case analyst.

Why deal with the headaches of managing the administrative operations for additional employees when we can do that for you?

We can provide you truly skilled and greatly experienced analysts – as many or as a few as you need – on your site or ours – and as frequently as necessary.

Systems We Have Worked With:

- Actimize

- AmLock

- Abrigo (BAM+)

- Bridger

- EastNets

- eGifts

- FCRM

- Ficrosoft/Acquity

- FiServ FCRM

- Global Vision

- Norkom/Detica

- Mantis

- Ocean Systems

- Prime Compliance Suite

- Proprietary/Custom System

- SAS

- Surety

- Verafin

- Wolters Kluwer

- Yellow Hammer