What you sow today, you will reap tomorrow.

-Unknown

Introduction

An old adage tells us, what you sow today, you will reap tomorrow. In our second installment of our four-part Looking Beyond COVID-19 series, we will discuss what we need to do today and start planning. While we don’t know exactly what it will look like when we return to our offices, or when it will happen, we do need to prepare for it with more than an “everything is back to normal” approach. So, what do you and your Bank Secrecy Act (BSA)/Anti-Money Laundering (AML)/Office of Foreign Assets Control (OFAC) team need?

Making Informed Decisions

There are multiple parts of making an informed decision. To start, you’ll need to know internally what successes and challenges you and your BSA/AML team experienced. Last week we covered the questions you should ask yourself and your staff, and the data points you should review. For example, was there an increase or decrease in alert/case volume, what temporary or permanent changes did you see in your staff, and what technological challenges to a work-from-home scenario did you see (such as a lengthy up-tick time to getting set up at home or the entirely lacking a work-from-home capacity). This information will lead your decision-making process on the next steps and help you write the plan.

There are multiple parts of making an informed decision. To start, you’ll need to know internally what successes and challenges you and your BSA/AML team experienced. Last week we covered the questions you should ask yourself and your staff, and the data points you should review. For example, was there an increase or decrease in alert/case volume, what temporary or permanent changes did you see in your staff, and what technological challenges to a work-from-home scenario did you see (such as a lengthy up-tick time to getting set up at home or the entirely lacking a work-from-home capacity). This information will lead your decision-making process on the next steps and help you write the plan.

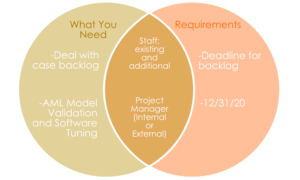

There are a variety of ways to see what your institution needs after analyzing the data; go with whatever way works best for your institution. One way is to use a Venn diagram that can demonstrate what you need versus the requirements. For example, on one side you might have a case backlog listed as the challenge and on the right, you’ll have a deadline in order to catch up. In the middle you have options – do you have the internal staff to complete the backlog by the deadline or do you need additional temporary staff? If the diagram had things like “AML Model Validation and Software Tuning” and “12/31/20”, perhaps in the middle you might find that what you need is a temporary project manager running those projects to keep them on track (whether you are using internal, external, or a combination of those resources). It is standard practice for our Model Validation Service to include Above-the-Line and Below-the-Line Testing. Contact us today to schedule a meeting to learn more about our AML Model Validation Service

Considerations and Contingencies

We will also need to consider or think of what other impacts “going back to work” will have. Since we don’t know when that will happen or what the impacts will be, it is likely to look different based on location. We will need to plan for alternative style openings. For example, splitting staff into shifts with one week on, one week off; or perhaps 50% of staff on day one, and the other 50% for day two. If splitting staff or delaying their return to work, do they have access – or will they continue to have access – to work-from-home; if not, that could delay your institution in getting AML projects and/or backlog, should it exist, back on track. This is something else that your institution will need to think about and possibly consider working with a third party vendor to hire a temporary case analyst. What else? What is specific about your institution or your access that you may need

Regulator Support

While the regulatory bodies have been pretty understanding thus far of banks and meeting their requirements – translation: they’re sympathetic as we’ve all experienced changes in our routines, however that doesn’t mean they will forego requirements. It is still important to talk to your regulators regarding their expectations as things being to return back to normal. Of course, as a whole, they haven’t changed, but if your institution is experiencing a backlog, then it’s best to be upfront with them and find out how quickly they expect you to catch up - or if you are reporting a problem, they will be happier and it will be better to describe your plan of how and when you will catch up. Most importantly, understanding what amount of time is reasonable. During this time, criminals are taking advantage of the chaos and shortage of oversight, and since we know that cyber and fraud related crimes are up, we suspect money laundering crimes are up too. Due to this, it is possible to see a higher level of scrutiny from regulators once things are back to normal. Finally, convey this information to the BSA committee, management, and Board, if necessary, to keep them informed and aware of your regulator’s expectations.

Conclusion

In the end, this plan will give a better understanding of where your institution stands internally. We have identified what did and didn’t work in your AML pandemic plan (assuming your institution had one, and if not, having one is a good place to start), additional consideration and contingency plans to have in place, and your regulator’s expectations. All of this will lead us to the third phase in the series, preparing for tomorrow.