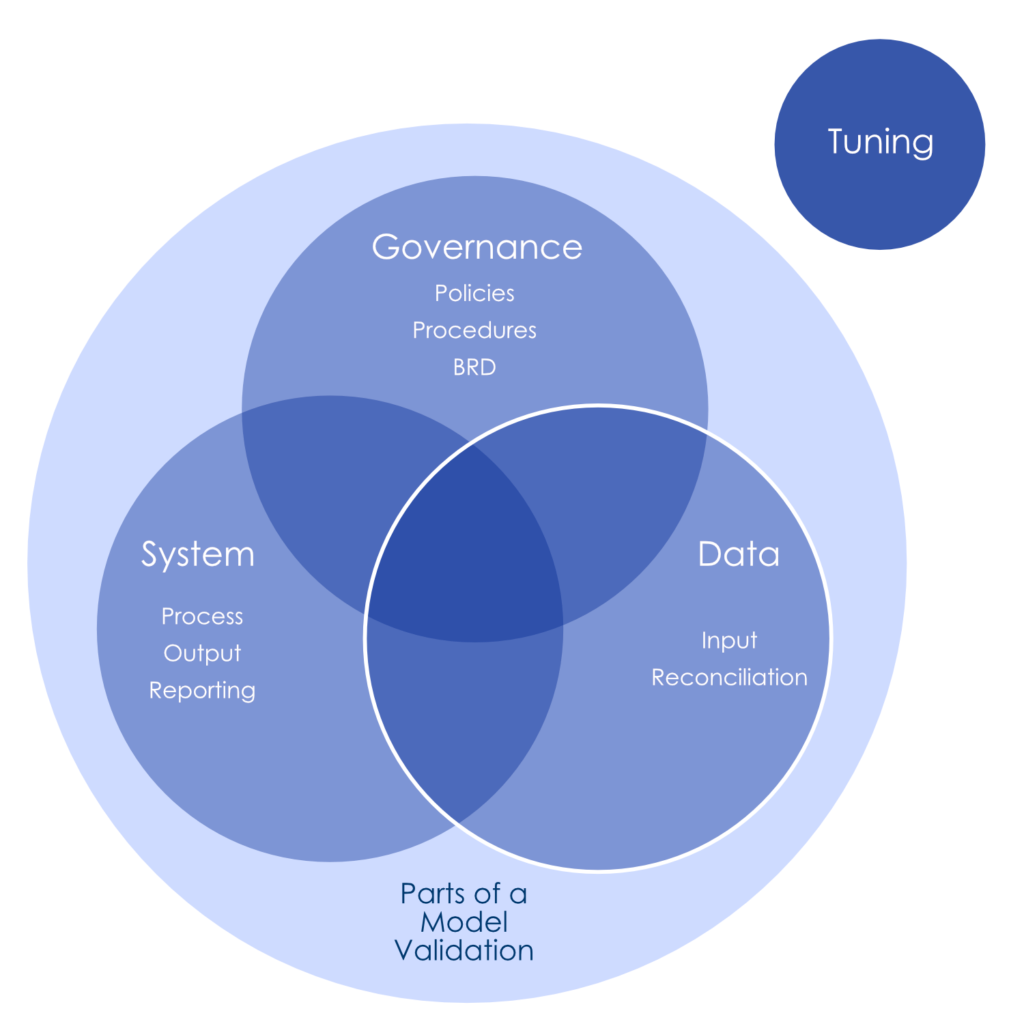

The purposes of conducting a software tuning optimization might be to balance the case analyst workload on a transaction monitoring system or make adjustments based on your customers, products or services, or the geography in which you serve has changed. While both of those are true, improperly setting up the software can also affect your alert/case volume, and simply may be inaccurate based on your risk assessment and program requirements.

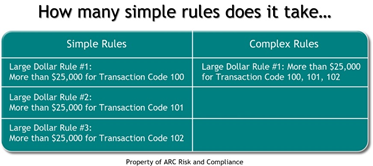

We often find while conducting model validations at financial institutions, credit unions, or other nonbank financial institutions they have implemented a system without fully identifying the requirements of that system. In these cases, clients are at risk because they are either receiving too much, which can make them inefficient on wasted alerts, or they aren’t receiving the most important ones because the system is missing a rule/threshold.

Our Tuning Optimization seeks to cover the workflow risk involved when there are excessive false positives that tax the capacity of those responsible for clearing the alerts. We also account for the risk of not capturing false negatives as true positives and the changing of data over time.

Interested in learning more about Software Tuning & Optimization?

Systems We Have Worked With:

- Actimize

- AmLock

- Abrigo (BAM+)

- Bridger

- EastNets

- eGifts

- FCRM

- Ficrosoft/Acquity

- FiServ FCRM

- Global Vision

- Norkom/Detica

- Mantis

- Ocean Systems

- Prime Compliance Suite

- Proprietary/Custom System

- SAS

- Surety

- Verafin

- Wolters Kluwer

- Yellow Hammer