“Our goals can only be reached through the vehicle of a plan. There is no other route to success.”

-Pablo Picasso-

Introduction

The influential Pablo Picasso once said, “Our goals can only be reached through the vehicle of a plan. There is no other route to success.” As we discussed in the prior three parts of this series, Looking Beyond COVID-19, we learned from our past, analyzed our present, and crafted a plan for our future. It’s time to round out the Looking Beyond COVID-19 series with part four: implementation. We will discuss kicking off our plan, the best ways to succeed and variables to consider.

Getting Started

Working with management, allows us to know who or what percentage of your Anti-Money Laundering (AML)/Bank Secrecy Act (BSA) staff will be returning to the office. Work with IT to get access for those who need it, such as remote workers, temporary staff (on or off-site), and vendor partners where appropriate. Meet with your “A” Team to get things started and have a kick-off meeting to make sure that everyone is on the same page – what are the expectations, what variables exist that could affect things (though we’ll get into this more later), and the deadlines to meet the project goals.

How to Succeed

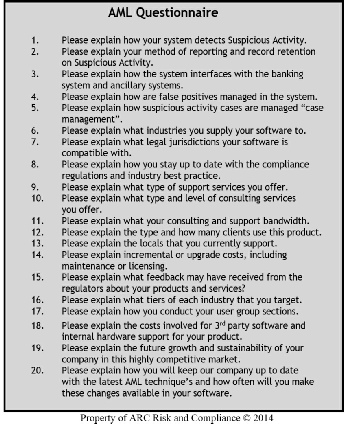

The best way to succeed is to have set milestones and progress reports. Depending on your goals, the frequency of reporting will vary, but let’s say every week or two. Beyond that, things can get too far away from you, making it even harder to explain if you miss deadlines later. Regularly checking in on your needs will also be important. Remind yourself what kick started this anyway. Was it a backlog of alerts/cases? Did the volume go up or down, and then what were the revisions to the plan that were associated to correcting, addressing, or reducing concern? Was it a backlog of AML projects that you had planned for the year that had been put on hold – a Risk Assessment, Policy and Procedure Updates, training? We may need to consider outsourcing these necessary projects to keep the team focused on the day-to-day functions that never go away. Was it an IT related project – Tuning, Model Validation, Look-Back, Cyber and Software Implementation? It’s typical for on-site bank IT to have limited staff and resources making it likely that you won’t be able to complete these AML related projects; consider outsourcing appropriate projects. Meeting the core requirements of this plan will be imperative to its success.

It is standard practice for our Model Validation service to include Above-the-Line and Below-the-Line. Our Model Validation Service validates that both halves of your AML software are working and ensures your process/program matches what it says you’re doing. Contact us today to schedule a meeting about for an AML Model Validation.

Variables

Every plan, project, or person will come with variables, contingencies, and things that go unplanned. Be prepared. If the COVID-19 pandemic has taught businesses, and people, anything, it is to be prepared. It put the business continuity plan (BCP) to test, and some came out winners and some did not. Keep in mind that things can go wrong both internally or through contract workers; it is important that all contingencies are thought through and planned for. Whether it be an increase or decrease, both will have their effects. It could also be that COVID-19 has not run its course and we can and should expect more to come down with it and not be able to report to work. Further, if it has not run its course, can your institution consider and allow remote work, if it hasn’t already? These are the effects that you need to consider as far as you can see (and not see) and, more importantly, plan for next time. There will be a next time.

Conclusion

We have covered several topics, approaches, and solutions over the course of this four-part series: Looking Beyond COVID-19. Thank you for sticking with me. We are ready. We’ve gathered data, met with our teams, met with AML professionals outside our institution (colleagues, vendors), laid out a plan, taken it to management, wrote in contingencies, and included all the ways for us to be successful. Hopefully, you have received the support you need and are ready for the next steps.

Don’t wait, start planning now while we have a little extra time. Gather the information, write the plan, and approach management. Once things do go back to normal, there will likely be a huge dash and a number of outsourced companies will not be able to support requests that aren’t planned for. Be ahead of the rush and chaos and plan for what your institution needs. ARC Risk and Compliance is always available to help you brainstorm, think through, and develop creative approaches to help your institution meet its needs thoroughly and effectively.